How $SIGN Simplifies Token Airdrops and Vesting for Web3 Founders

A practical guide for founders who want clean token distribution without the chaos.

Many Web3 startups use tokens as incentives rather than traditional equity offerings, helping boost community engagement. But managing these token distributions effectively can be complex.

For instance, if you’re a founder, you might rely on spreadsheets to track vesting schedules, allocations, and unlocks. The downside is that you risk errors, inconsistencies, and manual oversights. Even minor discrepancies can undermine trust among early contributors and investors, hurting a project’s credibility.

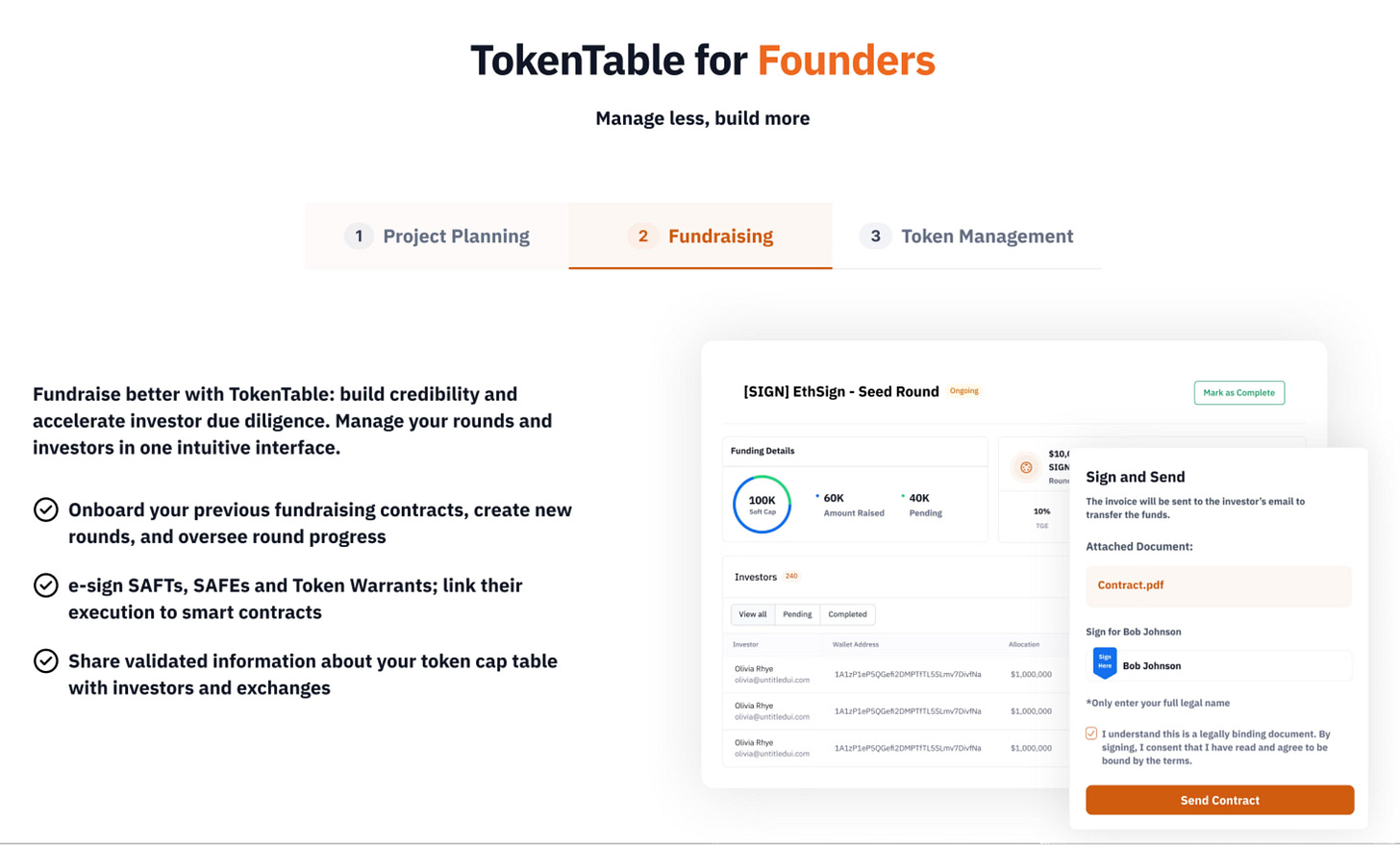

$SIGN and its associated tool, TokenTable, offer a compelling solution. They help move token management fully on-chain, enabling automated distributions and customizable vesting. They also provide a more auditable process that reduces risk and administrative burden. Below is an overview of how founders can leverage these tools to streamline token distribution.

Understanding TokenTable

TokenTable simplifies token distribution management by handling airdrops, vesting schedules, and unlocks entirely on-chain. It basically eliminates the need for fragmented spreadsheets. It also supports several blockchains, including EVM-compatible chains, Solana, and TON, which provides some flexibility for projects operating across these ecosystems.

The platform is a big player in the token distribution industry, managing over $4 billion in value across more than 40 million wallets and 200 projects. It’s also been tasked with conducting airdrops for Starknet, ZetaChain, and others.

Key capabilities include:

Customizable vesting schedules tailored to teams, advisors, and investors (with options for cliffs, linear releases, and more).

Simulations to forecast the impact of distributions on ownership dilution.

Automated, transparent unlocks that ensure fairness and visibility for all stakeholders.

These features make TokenTable a strong choice for projects requiring scale and reliability.

If you would like more insight into the vision behind Sign Protocol, I recommend this interview with CEO Xin Yan. I have no affiliation with $SIGN; this recommendation is based solely on the tool’s demonstrated use.

Practical guidance for founders

TokenTable is popular because it significantly reduces complexity in token distributions. Here are several recommendations drawn from best practices:

Begin early: Set up your TokenTable dashboard well in advance of any major distribution or token generation event. Early familiarization allows time to resolve configuration questions without pressure.

Maintain real-time oversight: Use the platform’s dashboards to monitor vesting progress, claims, and key metrics continuously. Proactive tracking helps identify and address potential discrepancies before they affect stakeholders.

Leverage automation: Configure automated unlocks to ensure timely, impartial releases. This minimizes manual intervention while reinforcing transparency for investors and community members.

Conduct thorough testing: Execute full simulations on testnets before any live distribution. This step enables experimentation with settings, identification of edge cases, and prevention of errors that could prove costly on mainnet.

Implementing these practices can make token distributions more efficient and trustworthy, freeing founders to focus on product development and growth.

Future-proofing your token strategy

As your project grows, your token management needs will grow with it, so a phased approach makes sense. Start with TokenTable for the core vesting and early distributions, then bring in more tools from the Sign ecosystem as things get more complex. A step-by-step approach keeps everything manageable and lets you leverage new on-chain governance features and incentives as they roll out.

If you’re facing token distribution challenges right now, TokenTable is a practical and proven option to consider.