Learning From Traditional Finance: The MicroStrategy Method

Wall Street called it reckless. The market called it genius. Both were right.

In traditional finance, reinvention almost never looks like this.

MicroStrategy was a quiet analytics company. Solid product, loyal enterprise clients, predictable margins. Then in 2020, it made a decision that broke every rule of corporate finance.

It stopped treating cash as safe.

Under CEO Michael Saylor, the company began converting its treasury into Bitcoin—first millions, then billions. What started as a small hedge turned into a full-blown transformation. MicroStrategy wasn’t just buying crypto. It was becoming crypto.

Wall Street called it reckless. Crypto called it visionary. Both were right.

The break from business as usual

For decades, MicroStrategy lived in the shadow of giants like SAP and Oracle. The business was fine. Boring even. Investors judged it the usual way: revenue growth, subscriptions, profit margins.

Then inflation spiked. Central banks printed more money. And holding cash started to feel like a slow leak.

Saylor saw it before most CFOs did: the real risk wasn’t volatility, it was erosion. So he flipped the script. Instead of buying Treasury bills, he bought Bitcoin. Instead of preserving capital, he went for asymmetric upside.

It wasn’t diversification. It was conviction.

Inside the playbook

The logic was simple but aggressive:

Use excess cash to buy Bitcoin.

Raise cheap debt through convertible bonds.

Use the proceeds to buy even more Bitcoin.

Every round of buying made headlines. Each purchase boosted the company’s market cap. As Bitcoin rose, so did MSTR stock, making it easier to raise new capital. The cycle reinforced itself. It was part financial engineering, part storytelling, all momentum.

By 2021, MicroStrategy wasn’t valued like a software firm anymore. It had become a high-beta Bitcoin proxy traded on NASDAQ.

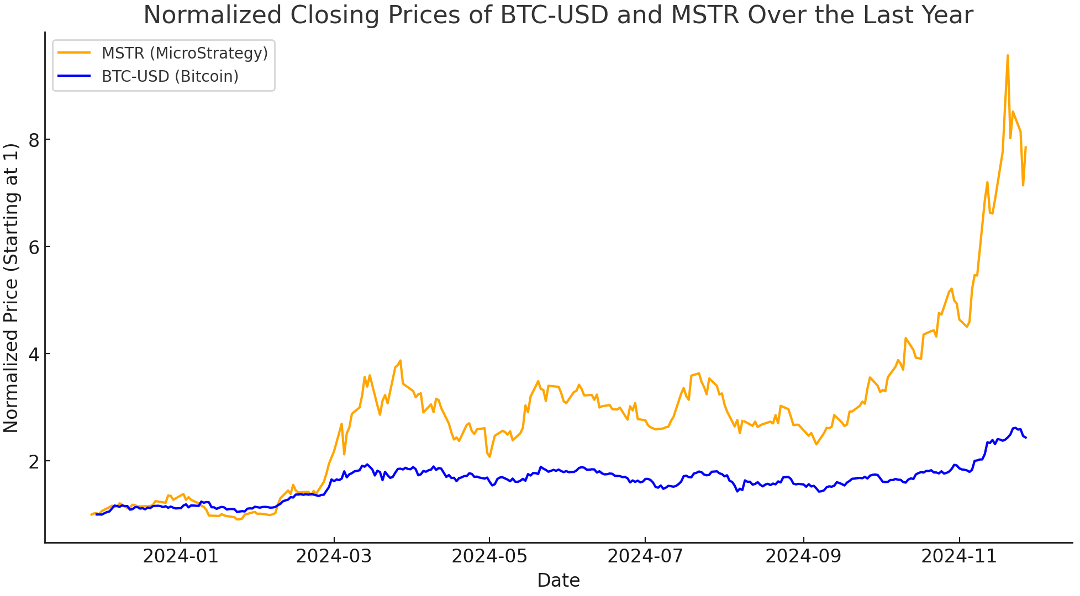

The numbers tell the story

From 2020 to today, MSTR’s stock has risen more than 2,700%. Bitcoin gained less. The market rewarded conviction.

Debt became leverage, not liability. Narrative became capital. And MicroStrategy’s balance sheet became a living thesis on belief in scarcity.

The fine print - risk, resilience, and reputation

The playbook works until it doesn’t.

MicroStrategy’s success rests on three fragile pillars: asset price, credit access, and market faith. Break any one of them, and the model wobbles.

A prolonged Bitcoin drawdown could hit both the company’s balance sheet and its ability to service debt. Higher rates make refinancing harder. And if sentiment turns, MSTR stops being a proxy for conviction and starts being a warning.

But here’s the twist: Saylor built for volatility. He designed the company’s identity to survive it. He’s betting that in an age of monetary uncertainty, clarity itself is an asset. Even when Bitcoin dips, his commitment signals strength. That’s the paradox of conviction. It attracts capital because it doesn’t flinch.

The playbook for everyone else

The MicroStrategy method isn’t about Bitcoin - it’s about alignment.

Capital, story, and structure all point in the same direction.

Rethink the treasury. Most corporate balance sheets sleepwalk through inflation. MicroStrategy proved that reserves can be an engine, not a vault.

Leverage as a signal. Borrowing isn’t reckless when it tells the market, “we believe enough to take a risk.” Used well, it communicates confidence more loudly than any press release.

Own the narrative. Saylor didn’t hide behind filings; he narrated the mission in real time. That transparency turned skepticism into curiosity, and curiosity into shareholder buy-in.

Play the long game. Momentum fades. Conviction compounds. MicroStrategy didn’t win by timing the market—it won by building a system that could keep going through chaos.

The takeaway: The courage to be understood later

MicroStrategy’s pivot will be studied for years. That’s not because it’s universally replicable, but because it redefined what “corporate strategy” can mean.

It’s proof that a public company can behave like a founder-led startup when the vision is strong enough.

It’s proof that balance sheets can tell stories.

It’s also proof that the only way to future-proof an enterprise is to take a bet no one else will touch.

The lesson isn’t “buy Bitcoin.” It’s that conviction, when structured through capital and communicated through story, that can become its own form of leverage.

In a world still addicted to incremental moves, that’s the real disruption.