The Hidden Fundraising Path Most Founders Overlook: The Micro-Round

Why the smallest checks create the strongest momentum

Lisa wasn’t raising money.

At least, that’s what she told herself every time she refreshed her inbox and saw another “Checking in on your fundraising plans…” email from a VC associate she barely remembered meeting.

What she didn’t expect was a message from one of her users.

Then another.

Then a third.

All within the same week.

“If you ever open a small round, I’d put in $100.”

“I’m not accredited, but I believe in this. Would love to invest.”

“Could you open something community-only? Even a few hundred dollars?”

These weren’t investors.

They weren’t investor whales.

They weren’t even early employees.

They were customers.

- People who used the product before it was pretty.

- People who gave feedback before she asked.

- People who would never get past a VC’s “What’s your background?” filter.

And that’s when the cognitive dissonance hit her.

Why is fundraising still built around $5M rounds when the people who actually care about the product think in increments of $25 to $250?

The experiment

On a quiet Wednesday night, she did something she never would have suggested to her board—if she had one:

She created a token allocation worth $12,500.

Not a seed round.

Not a SAFE..

Not a deck.

Just a micro-round.

She set the rules:

$50 minimum

No one could buy more than 2%

45-day linear vesting (programmed on-chain, no lawyers)

Wallet-based identity

No perks, no promises, no hype

She posted one message in her community:

“Opening a small on-chain micro-round for users who want ownership. First come, first served.”

She figured it might take a couple of weeks to fill.

It filled in 36 hours.

Half the buyers were names she recognized from support tickets and Discord threads.

The other half were strangers who had never commented once but had been quietly rooting for her success.

For the first time, she realized something that breaks the fundraising myth founders are raised on:

Capital isn’t scarce.

Alignment is.

The friction that made it real

The moment she announced the round, the questions started.

Not the kind VCs ask—

“What’s your TAM?”

“How defensible is this?”

“What’s your CAC/LTV ratio?”

Instead, much more grounded questions:

“Do I need to be accredited?”

“What wallet should I use?”

“Is vesting automatic?”

“Can I buy from outside the U.S.?”

“What happens if I lose my key?”

These weren’t objections.

These were signals.

Micro-rounds aren’t about creating investors.

They’re about converting users into owners.

And that single shift changes the entire incentive structure of an early-stage startup.

Her new micro-investors:

Shared every update on social

Caught bugs before she did

Recruited new users

Stayed invested emotionally, not just financially

Gave high-signal product feedback

Defended the product in online threads

Showed up to every roadmap call

Brought their friends to the onboarding sessions

She didn’t raise “capital.”

She raised momentum.

Why micro-rounds are a founder blind spot

The problem isn’t that founders can’t raise small checks—it’s that they’re taught not to see them.

Founders are conditioned to think in institutional amounts:

$100K check

$500K check

$2M seed

$6M Series A

But users don’t think in those numbers.

Users think in:

$25

$50

$100

$250

maybe $500 if they’re bold

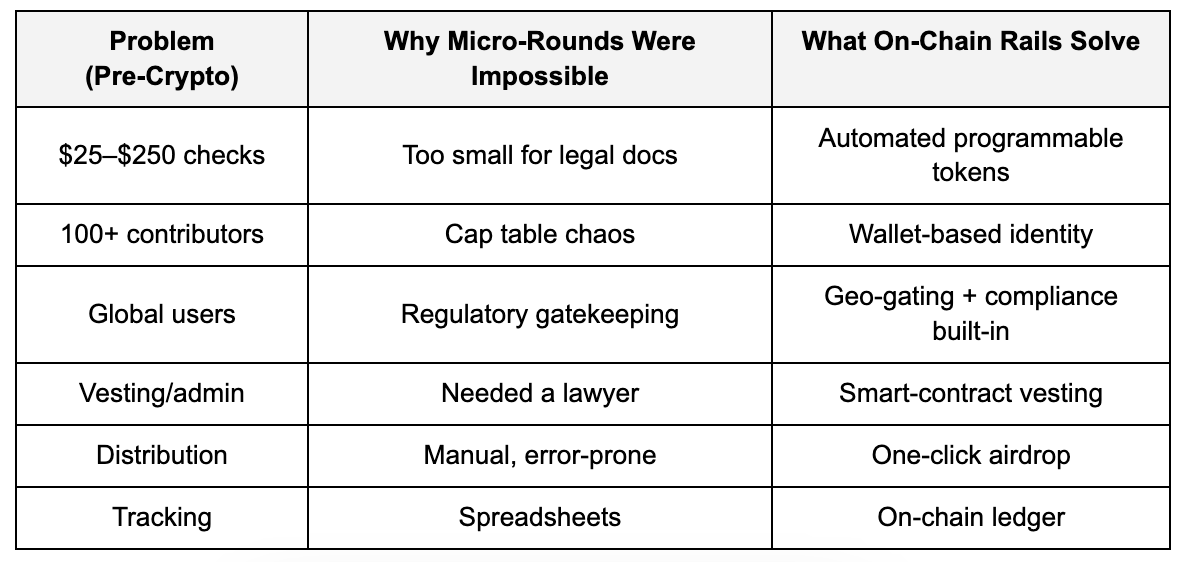

Before on-chain funding rails existed, taking those amounts was insane.

No lawyer would draft a SAFE for a $100 investor.

No cap table could handle 200 micro-checks.

No payment processor wanted that mess.

But programmable tokens changed that.

They automate:

per-wallet limits

vesting

lockups

distribution

revocation

identity

geographic access

community gating

The administrative cost goes from “impossible” to “runs itself.”

That’s the real unlock.

The reason micro-rounds were impossible wasn’t legal.

It wasn’t regulatory.

It wasn’t even operational.

It was infrastructure.

Now that the rails exist, the strategy becomes obvious.

What micro-rounds actually do

Micro-rounds don’t just add capital; they change the physics of your company.

Most founders raise capital to:

extend runway

ship faster

hire

survive

But micro-rounds create something different:

Alignment density.

When 247 people each put in $50–$100, you don’t have a cap table.

You have a movement.

You have:

247 evangelists

247 early adopters

247 distribution nodes

247 owners with skin in the game

247 people who want you to win because they benefit when you do

This is the kind of alignment no VC can manufacture.

It’s not money.

It’s leverage.

The loop back

Months later, when Maya finally spoke to VCs again, they didn’t ask about her deck.

They asked:

“How did you get 247 people to invest?”

“How did you raise this without a round?”

“Why are your metrics suddenly accelerating?”

“What is this community doing that we don’t understand?”

She didn’t pitch them.

They pitched her.

That’s the irony founders don’t see until they live it:

Micro-rounds don’t replace VC.

They make VC optional.

The micro-round framework most founders can copy

Don’t overcomplicate early funding. A micro-round keeps things fast and user-led—something almost anyone can copy.

1. Define a small on-chain pool - $5K–$25K is perfect

Small pools move fast. They signal scarcity and make it easy for early believers to jump in without overthinking it.

2. Set small, friendly minimums - $25-$100

Low buy-ins widen the door. It lets casual users, not just crypto insiders, participate and feel like early owners..

3. Cap maximums - prevent whales, keep ownership spreads

Hard caps keep one wallet from dominating the round. It also creates a healthier future community because more people have skin in the game.

4. Program vesting - 30–90 days, no custom legal work

Short vesting keeps people committed just long enough to stay engaged, but not so long that it feels like a trap.

5. Offer it to users first - not investors, not Twitter, not VCs

Your best early backers are the people who already show up. Prioritizing users builds loyalty and turns your community into evangelists.

6. Use wallet-based entry — no forms, no spreadsheets, no admin

Wallet gating keeps everything clean and reduces friction. If someone can’t join with two clicks, they probably won’t.

7. Keep it simple - no complex promises, no multi-year lockups, no governance bloat

The more rules you add, the slower everything moves. Micro-rounds work because they’re light, fast, and easy to trust.

8. Treat it as a “momentum round,” not a money round - alignment over capital.

You’re not trying to fund the company here. You’re trying to create energy, belief, and proof that real people want what you’re building.

The real lesson

Most founders think fundraising is about “getting capital.”

But micro-rounds flip the script:

You’re not raising money.

You’re raising believers.

And believers create more capital than capital ever could.

The concept of turning users into owners really hits diffrently when you think about traditional cap tables. When you have 247 people with skin in the game, you essentially have 247 reasons for your product to succed. This feels like a much healthier approach than chasing a few large checks.