Token-First vs. Equity-First: When Should a Founder Choose One?

Why sequencing your cap table may matter more than valuation in 2025.

Every founder in 2025 eventually hits the same fork in the road: do you launch your token first, or your company?

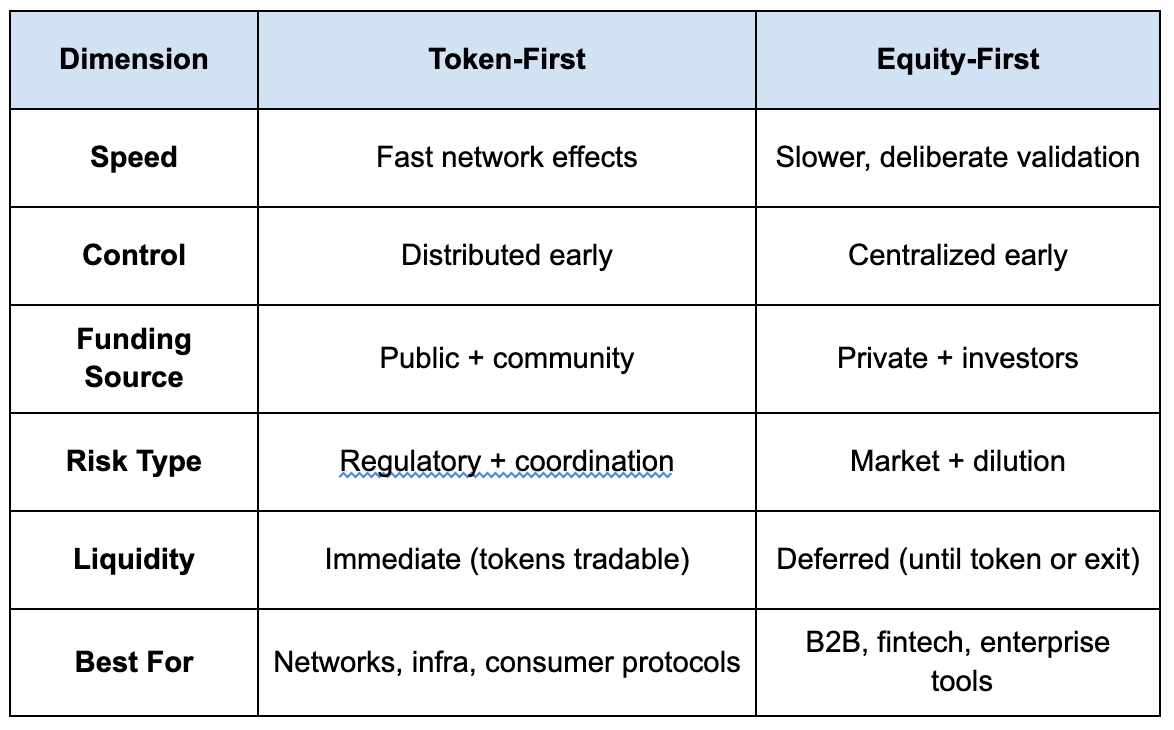

The decision isn’t about crypto ideology anymore. It’s about market design, incentives, and speed. The order you choose - token-first or equity-first - determines how you raise and how fast your community can form around you.

For the past decade, venture capital has followed a consistent pattern: forming a Delaware C-Corp, issuing common and preferred shares, raising equity, and shipping. Tokens were an afterthought, an “add-on” that came later, often wrapped in legal caution tape. But the post-2022 cycle flipped that script. Builders began to realize that capital, users, and governance could all be bootstrapped simultaneously on-chain.

Now the question isn’t whether to use tokens. It’s when

.

The token-first path for liquidity before valuation

A token-first launch is like going public on day one. But it’s with your users, not Wall Street, as the shareholders.

Founders who start with tokens want immediate alignment and liquidity. They believe the market can coordinate faster than a cap table can. Their tokens serve three purposes at once:

Funding mechanism. A public sale, launch auction, or liquidity bootstrapping pool replaces the seed round.

Community incentive. Tokens reward usage, referrals, or contributions without needing payroll.

Governance layer. Ownership spreads early, anchoring trust before any single investor dominates.

This approach fits products that are networks first, businesses second. Think exchanges, infrastructure protocols, data networks, or coordination tools—anything where participation equals value creation.

Celestia as an example

A good example is Celestia, which built its modular blockchain community before rollups launched. Early token holders became the evangelists and liquidity providers that made the network real. The same story played out with Arbitrum, Berachain, and dozens of others: liquidity and narrative built momentum long before traditional revenues appeared.

The trade-off is obvious: you gain users and visibility quickly but lose centralized control. Tokens make every decision visible and debatable. Regulatory scrutiny increases, and the founder’s “runway” is now measured not in cash but in community trust.

A token-first approach works best when:

The product depends on network effects.

You need market discovery more than private capital.

Your early users can double as evangelists or liquidity providers.

You’re ready to handle transparency and governance overhead early.

When those pieces align, token-first can be rocket fuel. When they don’t, it’s chaos dressed as growth.

Note: Tokenized assets (e.g., securities, treasuries, equities) have surged, with values exceeding $30 billion in 2025 (up from under $10 billion in 2023), and predictions of over $50 billion in tokenized securities alone. Private equity and fixed income lead, unlocking liquidity for traditionally illiquid markets.

The equity-first path to build before you broadcast

Equity-first founders take a more traditional route. They raise privately and bring in tokens later. At least when there’s something real to tokenize.

In this model, the token is a scaling tool, not a funding tool. Early equity rounds provide discipline and legal clarity. Founders can make mistakes quietly. Investors know their rights. Engineering teams can iterate without the distraction of price charts or governance spats on Discord.

Most enterprise and fintech-adjacent crypto projects follow this path. For instance, Fireblocks and Anchorage Digital built deep custody and security infrastructure long before introducing any token mechanics. The same is true for Worldcoin’s early phase, which was structured equity first, token second. It allowed them to handle compliance and infrastructure before distributing governance.

Equity-first works when:

You’re building complex or regulated tech.

The user base isn’t yet crypto-native.

You need controlled rollout and private iteration.

You plan to tokenize only once the core product-market fit is proven.

This approach trades hype for stability. It’s slower to build community traction, but it's also far less likely to implode from premature decentralization.

Note: Venture capitalists (VCs) in 2025 are increasingly backing Web3 startups that raise capital without immediate token launches. They’re prioritizing proven traction and operational discipline over speculative tokenomics. Over $16 billion has been raised in Web3 venture rounds this year. But with fewer deals, the focus has shifted to “traction-first” projects. It’s product first, token later.

Why sequencing matters

In a traditional venture, the order of ownership doesn’t matter much. Equity rounds followed predictable dilution curves. But in hybrid systems, where tokens and shares coexist, timing becomes everything.

Launching tokens too early can lock you into poor tokenomics or community expectations you can’t meet. Launching too late can mean missing the network flywheel that competitors are already compounding.

Think of it this way:

The sequencing defines the founder’s margin of control. A token-first project hands the wheel to the market early; an equity-first startup keeps both hands on the wheel until it’s time to scale.

The hybrid play: Anchor in equity, expand with tokens

The best builders now blend both. They start with a lean corporate structure, one that clearly defines equity. They add tight governance and layer tokens only when the community side of the business is ready.

In this “equity-anchored, token-scaled” model:

The C-Corp handles compliance, payroll, and IP.

A foundation or DAO oversees the token ecosystem.

Founders bridge the two through vesting schedules, on-chain voting, and transparent disclosure.

Projects like Optimism and StarkWare illustrate this well: early equity rounds funded R&D, and token distribution came once the product and community were mature. It preserved control while still inviting community participation later.

Hybrid sequencing lets founders tell both stories: a credible tech startup and a community-governed protocol. Investors get clarity, and users get ownership. It’s not either-or, it’s both, but in the right order.

Note: Founders can now issue tokens as “explicit cryptoequity” more frequently. These are blockchain-based equivalents to traditional shares, complete with lockups, vesting, and long-term alignments. This cryptoequity blurs the lines between token-first and equity-first approaches, allowing global liquidity while maintaining control.

What should founders ask?

Before choosing, founders should ask three simple questions:

What drives value in my system - product usage or network coordination?

If it’s usage (like B2B or infrastructure), equity-first makes sense. If it’s coordination (like DeFi or social protocols), token-first may accelerate growth.What’s my regulatory exposure?

A token launched without utility or compliance can backfire fast. Jurisdiction, KYC design, and legal frameworks must guide sequencing rather than follow it.Who do I need on my side first—investors or users?

Equity builds investor trust. Tokens build community energy. Knowing which is scarcer in your market clarifies the path.

The next era involves fluid capital formation

We’re entering a phase where capital formation itself is fluid.

Founders no longer need to fit into one box. They can start equity-first, airdrop tokens to users later, or even reverse the order by spinning off DAO ownership after the token matures. Liquidity and control have become variables, not constants.

The builders who thrive in this landscape are the ones who treat financing as architecture, not accounting. They design ownership the way they design products: iteratively and with intent.

In the end, token-first and equity-first are just starting points. What matters most is how deliberately a founder moves from one to the other. It's this transition, not the starting line, that determines who controls the company's future.

A token-first model builds markets.

An equity-first model builds companies.

The winners will learn to build both, and know when each one matters.