Tokenizing Future Revenue to Raise Capital Without Dilution

Turn predictable revenue into upfront funding without giving up equity or control.

Raising money is supposed to feel like progress. You announce a round, celebrate the check, and tell yourself you’re leveling up. But the part founders rarely talk about is the cost.

Every raise quietly takes another 20–30% of your company. After a couple of rounds, you wake up and realize you own far less of the startup you built.

There’s another way to bring in capital, one that lets you fund growth without giving up ownership. It starts with tokenizing a slice of your future revenue.

What revenue tokenization actually looks like

Let’s make this real.

Imagine a SaaS company called XYZ needs $5M in growth capital. Instead of giving up board seats and diluting their ownership, they tokenize 10% of next year’s ARR. Investors buy those tokens because they’re backed by verifiable revenue. Founders keep control. Investors get yield. Everyone’s incentives stay aligned.

These tokens look more like digital royalty contracts than anything “crypto.” They’re performance-linked claims on future income, enforced by smart contracts. No hype. No guessing. And because tokens can trade on secondary markets, investors get the liquidity that traditional revenue-based financing can’t offer.

The math here shifts quickly.

Founders often raise capital at 15–25% higher valuations simply by avoiding dilution. Investors receive returns tied to actual performance rather than theoretical multiples. Add arbitrage, tax optimizations, and hedging strategies, and you’re essentially engineering financial leverage while protecting your cap table.

How to structure revenue tokens so they work

If you decide to explore this, structure matters. The strongest revenue tokens aren’t IOUs; they behave more like performance-linked contracts.

Automate payouts with oracles

Using tools like Chainlink, you can tie token payouts directly to your real revenue. Each quarter, investors automatically receive their shares without waiting for reports or checking whether the numbers are accurate. This alone reduces default risk compared to unsecured loans.

Price the tokens intelligently

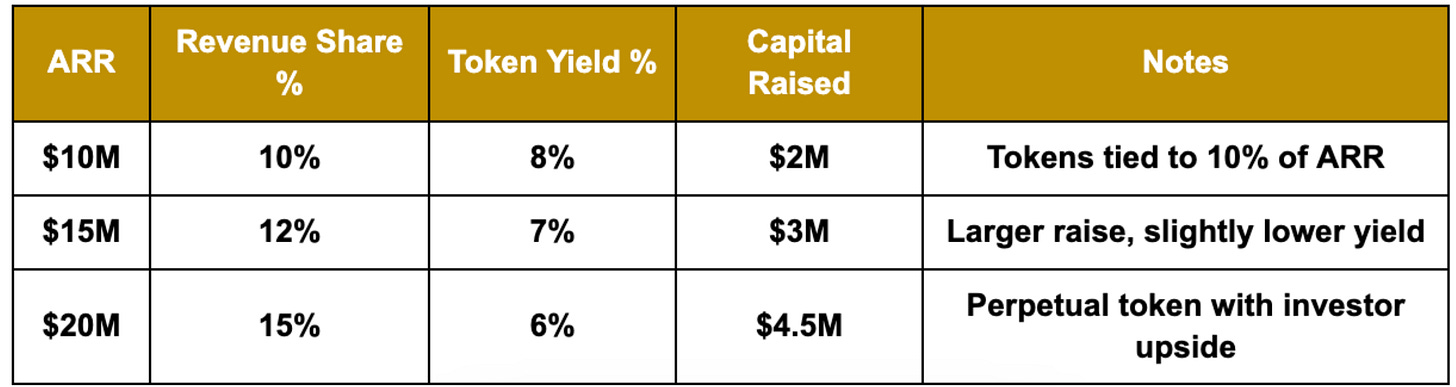

Let’s say your startup projects $10M ARR next year. If you sell 10% of that ($1M) and want to model an 8% effective yield, you might raise around $2M upfront.

A simple formula for this looks like:

Token Value = (Projected ARR × Share %) / (Discount Rate + Risk Premium)

You don’t need to love math. Drop this into Excel and run a few scenarios. You’ll see how investors get yield, and you get capital without dilution.

Add safety nets that protect everyone

Smart contracts can include conversion clauses. If revenue milestones aren’t met, tokens convert into equity. Investors get protection. Founders get lower effective financing costs, often 5–10% lower than traditional revenue-based financing.

Goldfinch’s 2024 numbers showed that revenue-token deals delivered an APY of around 12%, a healthy target for most investors.

Use market cycles to your advantage

You can create short-term revenue tokens (say, 18 months) and longer-term tokens that act more like perpetual streams. In hot markets, short-term tokens often trade at a premium. In slow markets, companies buy them back at discounts. This spread becomes another form of financial leverage.

Revenue tokens are not just for fundraising, but serve as a financial tool you can shape over time.

Remember, the token structure is where leverage happens. The best revenue tokens aren’t IOUs. They’re performance-linked hybrids with built-in automation and downside protection.

Automate payouts with oracles

You can tie token payouts directly to audited revenue using a tool like Chainlink.

Every quarter, investors automatically receive their share. There’s no reporting drag and no “trust me” conversations.

Automation cuts default risk by up to 40% compared to unsecured lending.

Price your tokens intelligently

Say you project $10M ARR next year. So you sell 10% of that ($1M) at an effective yield of 8%.

Token Value = (Projected ARR × Token Share) / (Discount Rate + Risk Premium)

Plug it into Excel, run a few scenarios, and you’ll see why investors like this structure.

It’s yield with transparency, a rarity in startup finance.

Add anti-dilution safety nets

Smart contracts can include conversion triggers. For instance, if revenue milestones aren’t hit, tokens convert into equity on pre-agreed terms.

For investors, that’s downside protection.

For founders, it drops your effective cost of capital by 5–10%.

Goldfinch’s 2024 data showed that revenue-token deals yielded an APY of around 12%, attracting serious institutional money.

Use arbitrage like a CFO, not a cowboy

With revenue tokens, you can create tiered tokens:

short-term (e.g., 18 months)

long-term (perpetual or semi-perpetual)

In bull markets, short-term tokens often trade at premiums.

In downturns, founders buy them back at discounts.

That’s a clean 10–20% spread, all from your own financing strategy.

Don’t treat revenue tokens as a one-time raise.

Treat them as a balance-sheet lever.

Compliance doesn’t have to be scary - it can be a moat

Tokenizing revenue without regard for regulations is a bad idea. But done right, it creates an edge.

Utility vs. security

After the SEC’s 2025 updates, there’s now more flexibility in positioning revenue tokens as “revenue participations.” Under Reg CF, you can raise up to $5M without full securities registration, saving serious legal costs.

Plan for taxes early

Because tokens are digital assets, you can often classify them as intangibles. That means you can deduct setup costs and sometimes defer a portion of capital gains using crypto-friendly structures. On a $1M raise, this can be meaningful.

But timing matters. Buying back tokens too quickly can trigger wash-sale rules.

Use jurisdictions wisely

Issue tokens on Polygon or a similar chain to reduce gas costs. Consider incorporating in a crypto-friendly jurisdiction to reduce audit overhead and connect with global liquidity.

Done correctly, compliance becomes a competitive advantage instead of a hurdle.

How DeFi makes revenue tokens more powerful

Once you’ve issued your tokens, you don’t have to stop there. You can plug into DeFi to unlock more flexibility.

Collateralize your tokens

If you’ve raised $1M in revenue tokens, you can often collateralize them for 70% of their value on platforms like Aave. That gives you an extra $700K in working capital at interest rates lower than most banks offer.

Wrap and trade

Convert your tokens to ERC-1155s and list them on decentralized exchanges. That creates liquidity for investors and gives you access to yield-seeking buyers.

Hedge your risk

Platforms like GMX let you use tokenized revenues as collateral for options. This means you can lock in predictable yields while others speculate on upside.

Activate your community

Add perks for token holders, like early access, discounts, or loyalty rewards. Many startups raise 10–20% more simply by letting their superfans participate.

Keeping the model healthy: exits and guardrails

If you go down this path, a few metrics matter:

Token velocity: If tokens trade 10–15 times monthly, you’ve created real liquidity.

Oracle reliability: Errors erode trust fast.

Buybacks: If revenue jumps, repurchasing tokens at a discount creates instant gains.

Don’t over-tokenize: Selling more than ~20% of projected revenue can squeeze your cash flow.

Tokenization isn’t only about raising capital today. It’s about building a financing model that gets more efficient over time.

Final thought

If you’re raising money in volatile markets, consider tokenizing a small slice of your revenue. It’s basically a dilution firewall. You get capital. You keep your ownership. And you build a financial structure that compounds in your favor.

You can even spin up a basic prototype using something like OpenZeppelin to see how the pieces fit together.