Why the Smartest Founders Are Using RWA Tokens to Win Traditional Capital

The Quiet Revolution Bringing Wall Street On-Chain

Most investors still treat crypto like a four-letter word.

They picture speculation, volatility, and a sort of regulatory roulette.

But here’s the quiet reality:

In 2025, tokenized U.S. Treasuries became the fastest-growing on-chain asset class. It’s outpacing Bitcoin, stablecoins, and every DeFi protocol combined.

That single data point cracks the myth wide open.

Crypto’s next phase isn’t about coins or casinos.

It’s about real-world assets, and the founders who know how to bring them on-chain.

The Reality Check: What Everyone Missed

For years, founders chased retail hype and retail capital.

Meanwhile, traditional investors like family offices, funds, and corporate treasurers decided to stay out. Not because they hated innovation, but because they couldn’t see where their money fit.

Now the script is flipping.

Tokenized real-world assets (RWAs) let investors back what they already understand. They include assets like real estate, credit, equity, and treasuries, while maintaining the safeguards investors rely on.

That’s the pattern interrupt: crypto doesn’t have to be risky to be revolutionary.

Why RWA Tokens Are Different

RWA tokens act as bridges, not bets.

They connect two systems that were never meant to talk to each other:

DeFi: fast, transparent, global.

TradFi: structured, regulated, familiar.

RWA tokens turn tangible assets into programmable ones, letting capital move with the speed of code and the trust of contracts. You’re not reinventing finance, you’re upgrading it.

For founders, that means something subtle but profound:

The next investor conversation won’t be about “understanding blockchain.”

It’ll be about how your tokenization model improves liquidity and trust.

The Insight Stack: How the Shift Plays Out

The shift from crypto speculation to real-world assets is happening in real time. RWAs are turning blockchain from a playground for traders into an infrastructure layer for capital itself.

Small win:

RWAs remove the obvious barriers. No more wallet tutorials or seed-phrase anxiety. Investors can onboard with custody solutions they already use.

Medium insight:

Once investors realize they can hold tokenized treasuries or real estate without volatility, “crypto exposure” turns into “yield strategy.” The stigma starts to fade.

Big revelation:

When you control both the asset and the rails, it moves on; you don’t just reduce friction, you redefine distribution.

That’s why RWAs aren’t a subcategory of crypto.

They’re the on-ramp for the next trillion dollars of capital.

The Founder’s Advantage

Picture sitting across from a skeptical investor. The word “crypto” tightens their jaw.

But when you start talking about tokenized income streams, audit trails, and on-chain compliance, something shifts.

They lean in.

That’s your opening.

You’ve turned fear into familiarity.

And in that moment, you’re not pitching a token, you’re designing a financial product, one that happens to live on a better system.

What Are RWA Tokens, Really?

Strip away the jargon: an RWA token is a digital proof of ownership for a real-world asset.

That could be a property title, a bond, an invoice, or even a yield-bearing account.

Instead of paper contracts and settlement delays, everything is recorded on-chain. It’s transparent, verifiable, and transferable.

They’re different from Bitcoin or NFTs.

Bitcoin’s value comes from scarcity.

NFTs from uniqueness.

RWA tokens derive value from tangibility - they’re assets investors already trust.

That’s the shift: from belief-based value to asset-backed value.

Why This Matters Now

Institutional capital is looking for yield that’s safe but accessible.

Retail investors are looking for ways to participate in private markets without the barriers to accreditation.

And blockchain infrastructure is mature enough to handle real-world scale.

These three forces are converging right now.

If the last cycle was about speculation, the next one is about integration. It’s where crypto stops trying to replace TradFi and starts quietly powering it.

The founders who see this early won’t just ride the RWA wave.

They’ll define what digital ownership means in the real economy.

How RWA Tokens Lower the Barrier

For most traditional investors, “crypto exposure” still sounds like a dare.

They’ve seen the crashes, the hacks, the headlines.

But when you talk about tokenized treasuries, fractionalized real estate, or on-chain credit, the conversation changes.

Suddenly, they’re not picturing speculation, they’re picturing structure.

RWA tokens give founders a way to meet investors where they already are:

a world that is defined by compliance, clarity, and comfort.

Here’s how they quietly dismantle the usual barriers:

Volatility: Backed by real assets, not sentiment.

Complexity: Custodial interfaces and regulated brokers abstract the blockchain layer away.

Regulation: Tokens live inside frameworks that already exist for securities and funds.

Perception: “Crypto” becomes “digitally settled finance.”

Trust: TradFi guardrails like audits, insurance, recourse are baked in.

The outcome? Investors get digital efficiency without the crypto chaos.

Founders get access to capital that used to stay locked behind legacy rails.

Use Cases That Actually Land

RWA tokenization works best when it’s invisible. In other words, when investors forget they’re using blockchain at all.

The strongest examples are the ones that sound ordinary, not exotic:

Tokenized Treasuries: Already a multibillion-dollar market. Ondo, Backed, and Franklin Templeton are proving institutions trust it.

Real Estate: Fractionalization lowers entry barriers and unlocks global liquidity.

Private Credit & Invoices: Yield-bearing assets that stay grounded in cash flow, not speculation.

Commodities: Gold and oil tokenization bring instant settlement to a market still stuck on faxes and clearing houses.

These aren’t new asset classes - they’re old ones that run on better software.

That’s the point.

RWA tokens don’t make investors abandon what they know; they make it move faster, settle instantly, and open to anyone.

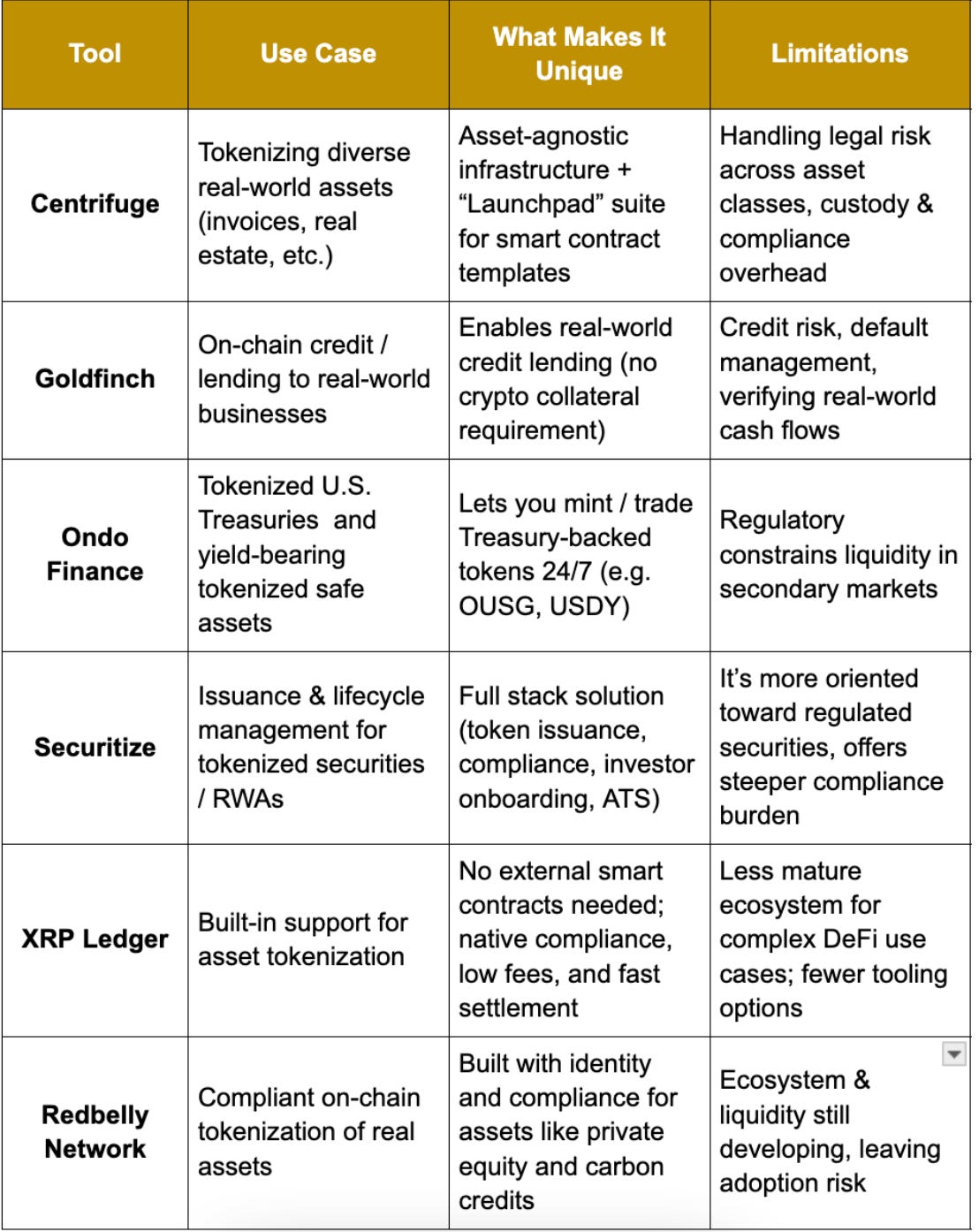

Here’s how this looks in real life, with several RWA platforms making waves:

Turning Skeptics Into Participants

The real friction isn’t technical, it’s psychological.

Investors need to know that if something goes wrong, there’s a legal framework, a custodian, and an audit trail waiting in the wings.

That’s where the ecosystem is catching up fast:

Regulatory clarity: Jurisdictions from Singapore to Switzerland are codifying digital asset laws, turning uncertainty into structure.

Custody solutions: Institutions can now hold RWA tokens with the same compliance standards as traditional securities.

Risk frameworks: KYC, AML, insurance, and on-chain audits make RWA investing look like a Bloomberg terminal, not a Discord thread.

Education: Plain language beats whitepapers. Clear communication builds trust faster than code ever could.

When these pieces align, the “crypto” label fades. What’s left just looks like finance, reimagined.

The Strategic Role RWA Tokens Play

Every founder chasing institutional capital is about to face a choice:

keep pitching yield, or start pitching credibility.

RWA tokens are the credibility play.

They bring the transparency of blockchain into the governance of TradFi. And that’s what finally attracts serious money.

Onboarding the next wave: Investors no longer need to become “crypto native.” The tech adapts to them, not the other way around.

For issuers and protocols: Supporting RWAs builds trust with regulators and institutional partners, expanding the total addressable market.

Network effects: Each new RWA adds depth and legitimacy to the ecosystem, making it safer and more liquid for everyone who follows.

The ripple effect compounds:

As RWAs scale, they pull in the very investors who once dismissed the entire category.

The same people who said “too risky” will soon call it “too efficient to ignore.”

Related: If you like exploring how markets misprice risk and where investors misunderstand value, I recommend The Financial Pen. It hunts for quality the market overlooks, probes opportunities it misunderstands, and writes with the kind of conviction that works well with what we discuss here.

The Status Upgrade: What It Means for Founders

If you’ve been building in Web3, this is your inflection point.

The next era of adoption won’t be won by those chasing yield. Instead, it will be led by those designing trust.

RWA tokens are your toolkit for that.

They let you frame blockchain not as rebellion, but as refinement.

Not as an alternative system, but as a better one.

So when you walk into that next investor meeting, don’t pitch them crypto.

Pitch them clarity.

Pitch them liquidity.

Pitch them the efficiency they can audit.

Because the founders who learn how to turn familiar assets into programmable capital aren’t just ahead of the curve, they are the curve. (Breaking Bad flashback incoming)

Final Takeaway

The future of RWAs isn’t about yield farms or hype cycles.

It’s about legitimacy.

It’s about giving investors the confidence to move capital at the speed of code, backed by assets they already trust.

That’s how crypto stops being an experiment and starts becoming the infrastructure of global finance.

John, good one Sir. "You’ve turned fear into familiarity" is the line that caught my attention. Finding a way to make things will turn out ok because there is a path to follow will help everybody. Well written John! I'm saving it.