Before You Launch a Token: A Founder’s Complete Fundraising Checklist

Everything you need in place before raising capital on-chain.

Most founders still think tokenized fundraising is experimental — a side bet for crypto projects. But the numbers are flipping that belief fast: more early-stage startups are now raising with tokens than through traditional seed rounds.

Here’s the twist. Tokenization isn’t about escaping VCs; it’s about building a faster, fairer version of ownership itself. Founders who master this structure are closing rounds in weeks rather than months. At the same time, their communities become both early users and early investors.

But the real winners aren’t the ones who rush to mint. They’re the ones who start with clarity, not hype.

Before you announce anything on-chain, make sure your foundation is solid.

This checklist walks through what to get right first: legal setup, token design, investor plan, and governance model. Follow these steps, and you’ll raise on-chain with confidence instead of confusion.

Step 1: Define the goal of the raise

Start with why you’re raising. It sounds simple, but many founders skip this part. They hear “tokenized fundraising” and jump straight to token supply or launch dates.

Ask yourself what the raise is really for. Are you funding product development? Building liquidity? Rewarding early users? Each goal shapes the kind of token you issue and how investors fit in.

If your goal is growth, a utility token might make sense. If you’re offering exposure to real assets or revenue, you’re moving closer to a security token. And if you want both, you’ll need to consider a hybrid model that balances risk and regulation.

The clearer you are about your goal, the easier it becomes to explain your project to investors. It will also help you design a token that actually works.

Step 2: Choose the right structure

Once you know your goal, decide how your raise fits into your company’s structure. This choice shapes everything that follows, like how you bring in investors, manage control, and stay compliant.

There are three main paths founders take: equity-first, token-first, or hybrid.

Equity-first means you raise the traditional way, then introduce a token later for utility or governance. It’s slower but familiar to investors.

Token-first puts your token at the center. Ownership, incentives, and community all connect to it. You’ll need stronger legal and technical support here.

Hybrid approaches mix both. You raise part equity and part token, giving flexibility while maintaining investor trust.

Look at your stage and risk tolerance. If you’re still testing product-market fit, keep things simple. If you’re scaling and ready for community ownership, a token-first or hybrid model can unlock new funding and alignment.

Step 3: Model token economics

Your token isn’t just a symbol, it’s a system. It defines who gets rewarded, how value flows, and what keeps your community engaged over time.

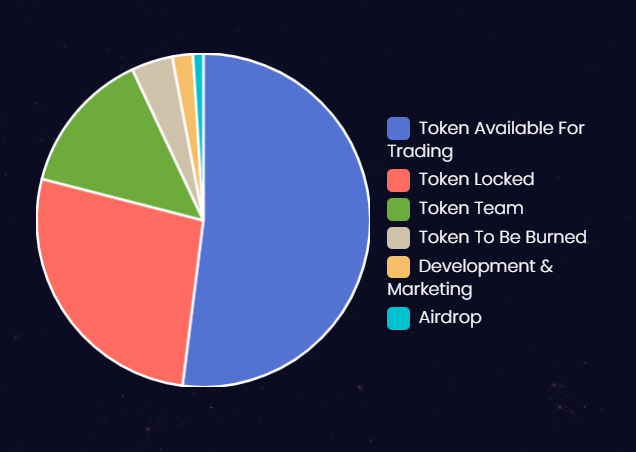

Start with the supply. You need to determine how many tokens will ever exist and who will get them. That requires splitting allocation among founders, investors, and users in a way that feels fair and aligned. Keep founder and team shares long-term vested so you build trust.

Next, design your emission or release schedule. Tokens that flood the market too early lose value fast. Aim for gradual unlocks tied to real progress, like milestones, user growth, or revenue.

Finally, test your model. Simple spreadsheets can show how incentives play out. Tools like Magna or Hedgey help simulate vesting and distribution. The goal isn’t perfection but clarity. Everyone should understand how the token creates value and why it’s worth holding.

Step 4: Set up your technical stack

Once your token model makes sense on paper, it’s time to build the foundation. Your technical setup should match your goals, not the latest trend.

Start with your blockchain choice. Each network has trade-offs. Ethereum has the biggest ecosystem but higher fees. Layer-2s like Base or Arbitrum can’t compare, but they offer lower costs and improved speed. Newer chains, such as Aptos or Sui, offer better performance but smaller communities. Choose what fits your project’s scale and audience.

Then define your token standard, such as ERC-20 for fungible tokens or ERC-721 for NFTs. But make sure your contracts are audited before launch. A single bug can ruin months of work and investor trust.

Finally, plan for custody and distribution. This means you’ll have to decide how you will store, release, and track your tokens. If you’re using a launchpad or manual transfers, make security and transparency your top priorities at every step.

Step 5: Investor readiness

Before you approach investors, make sure your story and numbers line up. Tokenized fundraising is still new for many people, so the clearer you are, the faster investors will trust what you’re building.

Start with your core materials. To begin with, you’ll need a clear whitepaper or token model doc, a simple pitch deck, and a roadmap that explains where funds will go. Think of it as your on-chain data room.

Investors want to see structure. Once you have that foundation, be ready to explain your token supply, lockups, governance, and how liquidity will form over time. From there, show how their tokens gain value as your project grows, not just through trading.

Finally, learn to speak both traditional finance and crypto. While many investors think in terms of equity, an increasing number focus primarily on tokens. As a result, be sure to translate your model for each side so no one feels lost. Clarity builds confidence, and confidence closes rounds.

The right stack keeps your token stable, secure, and ready to grow.

Step 6: Launch and liquidity plan

This is where your token leaves the lab and meets the market. A clear launch plan prevents chaos, price shocks, and credibility loss.

Choose your launch format wisely

A private round gives you control and time to test demand. A public sale builds community momentum but invites volatility. Airdrops can drive awareness, but without a strategy to convert recipients into real participants, they often create short-term noise. Pick the path that fits your stage, not your ego.

Set the rules for liquidity

Decide when and where tokens can trade, and who can access them. But make sure that liquidity pools or exchange listings are backed by adequate reserves. To avoid self-sabotage, use token lockups to help prevent early sell-offs and showcase long-term commitment. Promoting transparency in these details builds trust faster than any whitepaper can.

Measure what actually matters

After launch, success isn’t about your token’s day-one price. What really matters is who sticks around. Watch holder retention, trading volume stability, and on-chain activity. That’s how you’ll know if your tokenomics actually work and if people believe in where you’re headed.

Your launch isn’t the finish line but the start of market trust. Plan it with intention, and your token will have the foundation to grow beyond the initial hype.

Once your token is live, the real work begins. Launching gets attention, but governance keeps trust. The way you handle decisions, communication, and compliance after the raise determines whether your project scales or stalls

Step 7: Governance and compliance post-raise

Most founders treat the token launch as the finish line. But data from dozens of on-chain projects tells a different story: the real reputational risk starts after the raise.

Here’s why that matters right now — post-launch governance failures are becoming one of the top reasons tokens lose community trust. Not hacks. Not liquidity drops. Governance.

That’s the quiet truth: once money hits your wallet, your biggest challenge shifts from raising capital to keeping credibility.

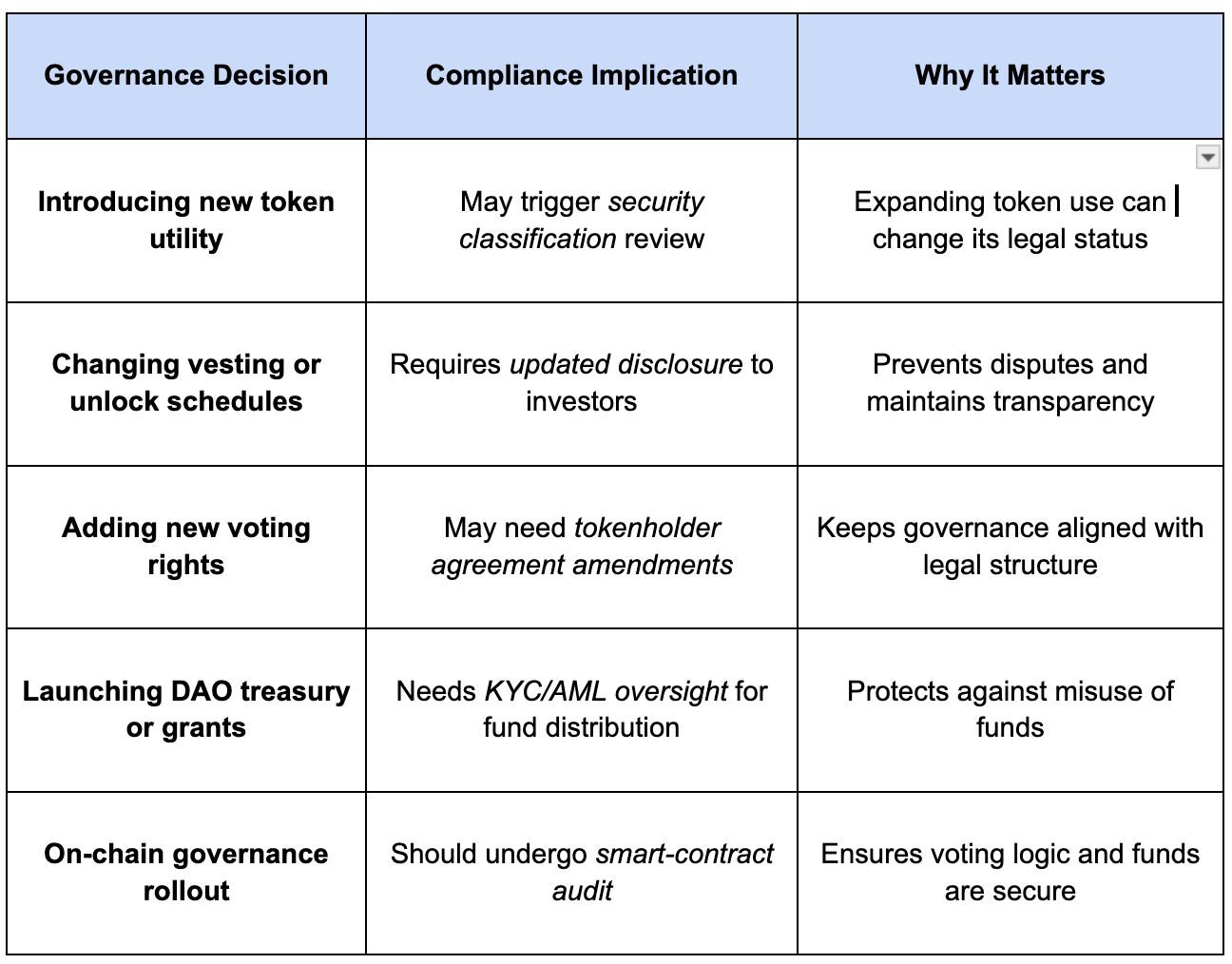

Define how decisions get made. Who votes, who proposes, and how disputes get resolved. The earlier you codify that, the less chaos you face later. Then, make those rules public. Transparency turns speculation into trust.

Internalize compliance as mandatory. Regulations are shifting fast, and ignoring them doesn’t buy you time; it buys you exposure. Build a lightweight system for audits, reporting, and legal review that scales with you.

Connect governance and compliance. When your token holders see that decisions and regulations align, they’ll sense durability. This is the single most underpriced signal in Web3 right now.

Governance isn’t paperwork. It’s how markets decide whether your project deserves to exist tomorrow.

Next, stay proactive about compliance. Regulations around digital assets evolve quickly, and what’s acceptable today might not hold true tomorrow. That’s why maintaining legal counsel and proper documentation is essential for long-term survival.

Finally, align your governance and compliance efforts. When your token holders see that your decision-making and legal frameworks work together, confidence grows. Transparency and accountability are what separate enduring projects from short-lived ones.

The founder’s shortcut

Don’t start with tokens. Start with structure and purpose.

Tokens amplify what already exists - they don’t replace it. If your incentives, governance, and community design are solid, tokenization becomes infrastructure, not hype.

The shortcut isn’t minting faster. It’s building something worth tokenizing.

If you want a head start, I’m putting together a tokenomics template and guide that walks founders through this process - from cap table to token table - step by step. It’ll be out soon on Founders Capital.

John, love this newsletter. Passing it to my partners. Also, thanks sir for the gift. Have a fantastic day!