Token Tables 101: How to Structure Ownership On-Chain

A simple guide to designing ownership that scales with your community.

Most founders think they know their ownership structure.

They have a cap table, a spreadsheet, and a lawyer who says it’s all “by the book.”

But that book was written for a world where equity stayed private, liquidity took years, and your users didn’t expect a stake in your success.

On-chain startups flipped that script.

Today, founders don’t just raise capital, they raise participation.

The people who use your product can also fund it, govern it, and trade it.

The result is an ownership model able to handle investors, team members, and a public market… all at once.

Here’s the twist: most founders still try to manage this new reality with old tools.

They cling to their cap table when they should be designing a token table. In other words, a live and transparent map of who owns what, how it unlocks, and why it matters.

The future of fundraising isn’t just about who gives you money.

It’s about who you trust to hold your project together when markets move.

Getting this right is basic, like a required 101 class every founder should take before raising on-chain.

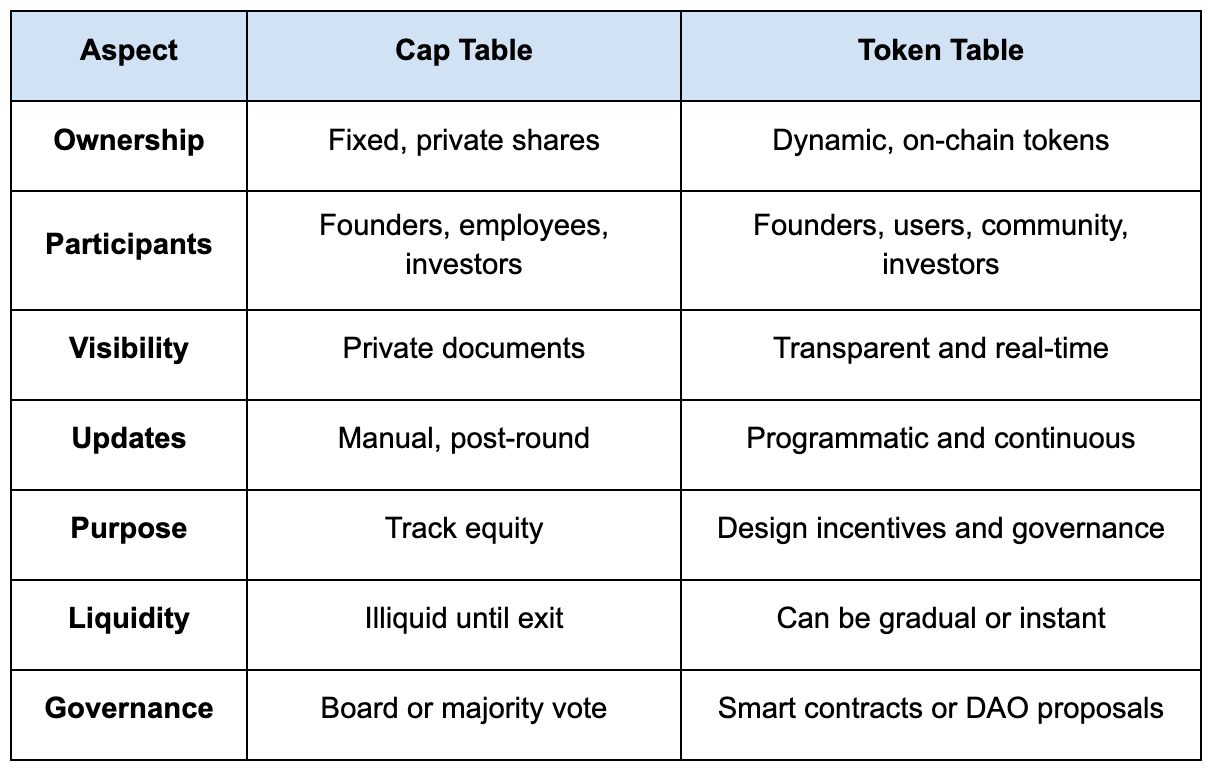

Moving from cap tables to token tables

A cap table used to involve founders, investors, and maybe a few employees. Everyone knew their slice of the pie, and ownership changed only when another round closed.

That system worked when capital moved slowly. But tokens changed the physics of ownership. Suddenly, founders could raise capital, reward users, and launch liquidity all at once. What used to take years can now happen in weeks.

But the cap table isn’t built for that kind of speed. It tracks who owns equity, not how ownership moves. Tokens made ownership dynamic because its programmable, tradeable, and visible to everyone. That means founders need a living map able to show where control sits and how it flows over time.

That’s what a token table does. It’s not just an investor ledger, it’s a design system for incentives. It shows how supply unlocks, who earns what, and when liquidity becomes real. And it’s becoming more commonplace.

In other words, if a cap table tells you who built the company, a token table tells you who keeps it alive.

What a token table actually is

At first glance, a token table looks like a spreadsheet, displaying columns, percentages, and even vesting schedules. But underneath, it’s your economic blueprint - the plan that defines how control and value flow through your project.

A traditional cap table answers one question: who owns what?

A token table answers four:

Who earns tokens?

When do they unlock?

How are they used?

And what happens when markets move?

It’s the connective tissue between your idea, your investors, and your community.

Every token in circulation tells a story about intent, revealing how early believers are rewarded, how contributors stay motivated, and how outsiders become insiders over time.

That’s why token tables aren’t just operational. They’re psychological. They shape how people behave around your project. A messy table creates confusion and sell pressure. A clear one builds alignment, helping participants understand the rules, and trust the system enough to stay in it.

When you think of your token table as part ledger and part behavioral design, the structure stops feeling like paperwork. It starts feeling like a strategy.

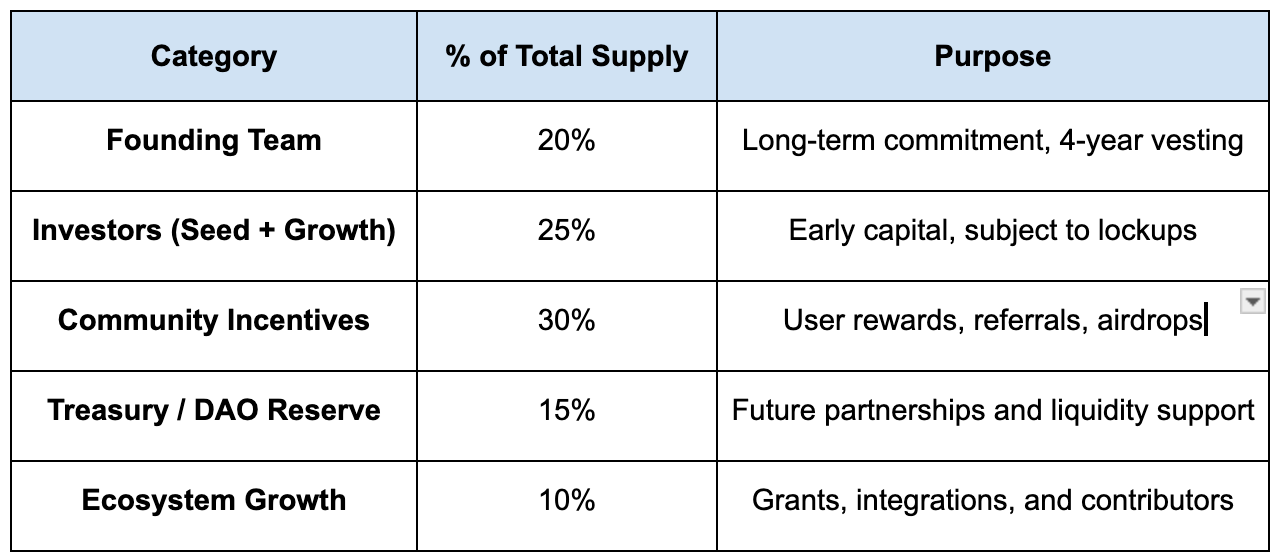

The building blocks of a token table

Every solid token table starts with five simple pieces. Once you see how they fit together, the whole system feels a lot less abstract. It begins to reflect what you already know from traditional fundraising.

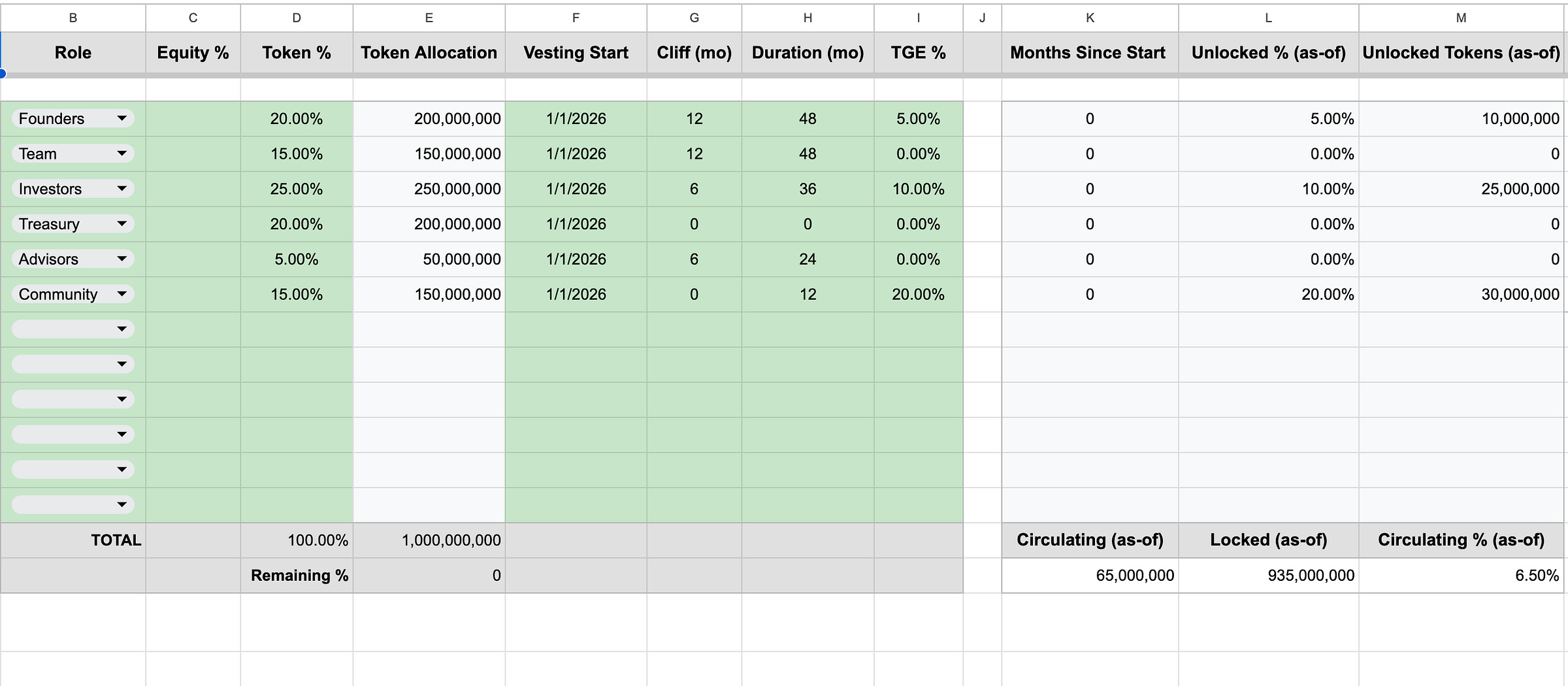

The spreadsheet below is a sample token table I’m working on. In column B below, you can see that various token participants (like above) are listed from a drop-down menu. The corresponding percentage of total supply reserved for participants here is listed in column D.

Not incidentally, the green-shaded cells represent editable values and the gray cells represent calculated values. The numbers may make your eyes glaze, but everything becomes much more readily apparent when plotted on a chart.

Let’s take these terms apart:

Equity % — The percentage of company ownership represented by traditional shares held by a founder, investor, or team member.

Token % — The percentage of total token supply allocated to a specific holder or group.

Token allocation — The number of tokens assigned to an individual, investor, or category within the overall supply.

Vesting start — The date when tokens begin to unlock or accrue toward ownership for a participant.

Cliff (mo) — The initial period (in months) before any tokens vest, ensuring recipients stay committed past a minimum timeframe.

Duration (mo) — The total length of the vesting schedule, from start date to full unlock.

TGE % — The portion of tokens released immediately at the Token Generation Event (launch day).

Months since start — The time elapsed (in months) since vesting began for a particular allocation.

Unlocked % (as of) — The percentage of a holder’s tokens that have vested and are available as of a specific date.

Unlocked tokens (as of) — The actual number of tokens currently available to the holder based on the vesting schedule.

Circulating (as of) — The total number of tokens available in the market (not locked or reserved) at a given date.

Circulating % (as of) — The share of total token supply that’s currently circulating and tradable.

Locked (as of) — The number of tokens still restricted under vesting or lockup conditions as of a given date.

A good token table tells a story about balance. Every decision echoes your values: who you reward, who you trust, and how your community grows.

Common mistakes founders make

Even with the best intentions, most founders trip over the same few patterns when building their token tables. But once you spot them, they’re easy to fix.

Here’s what to watch out for:

Over-allocating to insiders.

It’s tempting to reward yourself and the early team heavily. But when too much supply sits in one place, community trust quickly erodes. Plus, the market reads imbalance as risk. A healthy table always leaves room for users and contributors to earn ownership too.Ignoring liquidity timing.

Founders often plan around total supply but forget about circulating supply, what’s actually tradable. If too many tokens unlock early, sell pressure can crush momentum before your product gains traction. To avoid this, stagger unlocks to match real usage.Rushing governance.

A token without clear decision-making rules is like a company without a board. Launching governance too early (or too vaguely) invites confusion. Your best bet is to treat it as part of operations, not a milestone to announce.Designing for hype instead of alignment.

Chasing quick liquidity or influencer buzz feels exciting, but it rarely lasts. Every shortcut in design becomes a long-term cost in trust. Don’t invite bad decision-making into your life.

None of this requires a PhD in tokenomics. If your token table rewards participation, spreads risk, and unlocks ownership gradually, you’ll already be ahead of most launches out there.

Designing for alignment, not hype

Most token launches look exciting from the outside. Participants notice flashy graphics, Discord buzz, countdown timers. But once the confetti settles, many of them still don’t know why the token exists.

That’s where alignment comes in. The goal isn’t to make your token popular, it’s to make it meaningful. A well-structured token table makes sure every participant, from your earliest contributor to your newest user, is rowing in the same direction.

Founders who get this right design incentives that pull people closer over time. They program tokens to unlock slowly and flow to those adding value. Likewise, they make sure governance is earned through participation rather than hype. It all seems commonsensical in retrospect, but in the middle of a launch, clarity is the first thing to disappear.

While markets can be loud, alignment isn’t. It’s the quiet intention behind every loyal supporter - and it’s what keeps your project steady when prices swing and attention drifts.

One founder I spoke with put it perfectly: “When people understand how they win, they stick around.” That’s the heart of a good token table, a design that gives everyone a reason to care.

Bringing it all together

Designing a token table is all about clarity. The structure you create today decides how trust flows tomorrow. When ownership, incentives, and liquidity align, you don’t just raise capital, you build confidence that lasts beyond market cycles.

Start simple. Sketch your total supply. Define who earns what and when. Map out vesting, lockups, and governance in plain language. These small steps create the foundation investors, users, and contributors can rally around.

You don’t need a tokenomics consultant or a $10K legal model to get started, you just need a framework that forces you to think clearly before you launch.

If you want a shortcut, I’ll be offering a Tokenomics Design Template soon to help founders do exactly that. It provides them with a structure their token table with confidence.